Stormy weather at Triplepoint Capital (NYSE: TPVG) (part 1 of 2)

“Don't know why

There's no sun up in the sky

Stormy weather” Etta James (1960)

Having spent 6 months or so outside of the venture world (i.e. operating solo and without a ‘dog’ in the fight) it now feels like there will be no better time to publish 3+ years of thinking and research on a public stock in the venture lending space - Triplepoint Capital (NYSE: TPVG). Having spent 9 years in and around the venture credit world historically, it has become clear to me that things at TPVG are not what they seem (with this coming mostly at the expense of public shareholders). With a 12 year bull market in the global venture capital world coming to an end (53% less funding in Q1’2023 vs Q1’2022), it is at this point of higher rates and less available venture funding that I am most concerned about TPVG’s business.

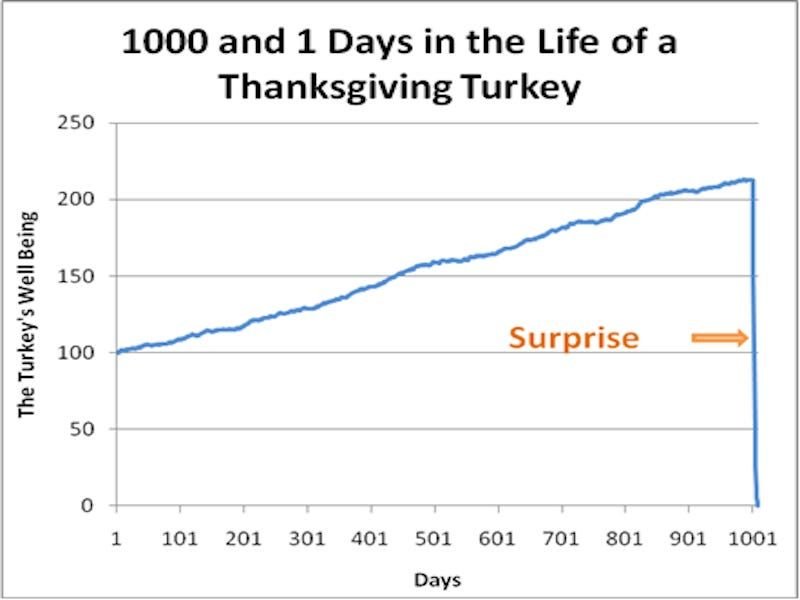

Firstly, some history and background on Triplepoint. Triplepoint Capital has been a venture lending fund in the US for 20+ years, opting to go public as a BDC in 2014 and growing its capital base from there as a publicly-traded entity (alongside it’s pre-existing private lending funds). TPVG’s senior management previously spent time at the helm of Comdisco’s venture leasing and investment arm which went into bankruptcy and was subsequently sold for assets to GE Capital in 2001; management had over-leveraged the balance sheet with debt whilst making bad loans during the height of the technology bubble (according to public sources). Out of the ashes of Comdisco arose Triplepoint circa 2006 to continue lending to technology companies with what one might think were lessons learned from Comdisco’s demise. Nonetheless, Triplepoint’s management biography section on its website makes no mention of Comdisco’s demise during their tenure (only referencing the prior thirteen years of profitability in a somewhat poignant analogue to Nassim Taleb’s case study of the Turkey before Thanksgiving) :

“Prior to co-founding TriplePoint, Mr. Labe founded Comdisco Ventures in 1987, the venture division of Comdisco, Inc. He led the division as CEO for more than 15 years, managing more than $3 billion in lease and loan transactions to more than 970 leading venture capital-backed companies. Under his leadership, Comdisco Ventures recognized thirteen consecutive years of profitability representing more than $500 million in cumulative pre-tax profits. Comdisco Ventures was recognized by BusinessWeek, Forbes, The Red-Herring, and other industry publications as the leader of the venture leasing and lending industry.”

Nassim Taleb’s Thanksgiving Turkey example (from The Black Swan)

Secondly, a simple Google search will take you to the firm’s Glassdoor reviews which paint a negative picture of senior management and their conduct running the business. Now the odd employee review here and there may hold bias but the available reviews in the aggregate should be directionally correct. Departing employee review titles include “DO NOT WORK HERE”, “Dishonest and unethical management. Stay away” and “Watch out” whilst also referencing “everything being shady and opaque”.

In fact looking deeper into the business in recent years with the focus on senior management, it is clear these negative themes stretch to other aspects of the business, specifically how financials and core metrics are reported to public shareholders. This takes form in a few examples just by digging through the public reports and building a view of the loan book from the ground up. Upon high-level evaluation of the earnings reports, the first problem that jumps out is the delta between signed term sheets (i.e. non-binding commitments to companies) and facilities that are legally created between TPVG and a portfolio company. In 2022, TPVG signed $2 billion in new deals (via signed term sheets) but only closed $594 million in new debt commitments. Given it takes roughly 1-2 months to close a loan deal from signed term sheet to signed documents, this lag might account for 5-10% of this gap but doesn’t account for the 71% difference. Reading between the lines either the 'commitments' in term sheets that TPVG makes shrink drastically in the legal documents (most likely), or TPVG seems to pull out of a lot of signed term sheets they have with potential portfolio companies (less likely given reputational damage) or most companies pull out of the deal process (which seems very unlikely). Given the 1-2 month time lag and some modest deal leakage one might expect this ratio to be closer to 80%, not 29%. My feeling on this is that a hypothetical $10 million investment from TPVG actually only legally means $3-4 million given the misleading headline term sheet figures. For whatever reason this fake commitment strategy hasn't caught up with the firm though it’s possible this became accepted practice in the US venture space (and venture funds and companies knew this going into discussions with TPVG). Having listened to a few of TPVG’s earnings calls, it’s surprising no public stock analyst has flagged this with the TPVG management team.

Before evaluating TPVG’s loan book, here’s some context on how venture lending firms generally should assess credit quality. Lenders tend to bucket risk by business model/end market, with B2B SaaS (Software-as-a-Service) being the most resilient in terms of downside protection/enterprise value (businesses are more resilient than consumers to sell to) and consumer applications/retail/ecommerce businesses being the most risky in terms of business model (given they can have supply chain risk, are less capital efficient given inventory and marketing spend, are lower gross margin than SaaS, have higher churn and tend to exit for lower multiples as they are typically valued on profitability not revenue and have less intellectual property etc). Moreover, in the growth stages of a startup's lifecycle, it is generally much easier to turn a B2B SaaS company profitable (high gross margin recurring revenue and low marginal costs) than consumer retail companies (higher churn, lower gross margin etc) and so the consumer companies tend to be more dependent on funding unless real scale is achieved (which is rare). With venture funding decreasing significantly in the last 6 months (especially in the growth/later stages where TPVG invests), many VCs have prioritised funding more resilient business models (B2B SaaS) and moved away from cash-burning consumer companies generally.

Bearing this in mind, how TPVG senior management represent the loan book to public shareholders is worrying. Below is a snapshot of the loan book based on senior management’s assessment of industry verticals:

However, spending half a day accurately re-segmenting companies based on their business model/end-customer segment results in a much more problematic loan book:

The true picture of TPVG’s loan book has 78% exposure to the higher risk consumer businesses (vs. 49% as represented by TPVG). Adding in additional data sources such as Crunchbase and public announcements in the loan book, in fact 35% (i.e. 28% of the total loan book, or $242 million of exposure) of these consumer portfolio companies haven’t publicly raised capital for over two years. Most startups raise capital to finance a plan for 2-3 years so this 2 year cut-off is key in assessing risk. Now some of these companies will have done unpublicised rounds led by internal investors but in the aggregate I don’t think it’s unreasonable to estimate that 15-20% of the total loan portfolio is in a very high risk category (higher risk business model and lack of recent venture funding) that is not accurately represented in the public filings. To take 4 examples:

Quick Commerce Ltd (known as Zapp) is a $21 million loan exposure - it is a consumer retail quick food delivery company in the UK. TPVG buckets this as a 'Business Products and Services' company.

Forum Brands is an acquirer/amalgamation of consumer ecommerce companies and a $29 million loan exposure. TPVG buckets this as a 'Business Products and Services' company.

Mind Candy (now called Moshi Kids) is a loan that TPVG restructured in 2017 to go payment-in-kind (i.e. accrued and deferred) interest at 12%. This appears to have started as a $6.5 million loan and has now grown to $20 million in exposure given 5-6 years of accruing yet unpaid interest. TPVG holds this loan at a fair value of $19 million (i.e. expecting a full repayment based on management’s current assessment and no impairment). Looking closer, Moshi Kids hasn't raised more than £1.7 million since April 2020, generates £5.3 million in annual revenue (growing 15%, whilst burning £3 million per year) and has 40 employees. The Company’s directors stated in the 2021 annual report that to sign off as a going concern the loan will need to be restructured. To think that the current expectation from TPVG management is full repayment of the £19 million loan to this small low-growth unprofitable consumer company is worrying.

The Pill Club is a $30 million loan exposure for Triplepoint (with $19 million exposed within the public TPVG vehicle and the remainder in the private fund). The Pill Club went into bankruptcy protection in April 2023 with the last equity round of $41 million being raised in Dec 2021. More recently the Pill Club reached an $18 million settlement for Medicaid fraud in California on February 10th 2023. TPVG announced Q4 earnings on 1st March 2023 and in that later assessment holds the loan at fair value of $19 million (despite the impending bankruptcy, the last round being almost 2 years ago, and half the cash from this round having just been spent on a fraud lawsuit which has its own implications).

To summarise this first topic (in a two part blog post) - it is clear that senior management has consistently misrepresented factors important to Triplepoint’s public investors and potential customers: the prior experience at Comdisco (leading to taking on too much debt, making poor credit decisions, a bankruptcy/asset sale and wipeout of shareholders), issuing fake commitments to prospective companies and creatively bucketing the loan portfolio to demonstrate diversification whilst also adopting an overly optimistic assessment of repayment expectation to prop up the financial performance in the public filings. Even with propping up the numbers, TPVG’s NAV per share (i.e. what is owned in loans vs what is owed in debt, divided by shares outstanding) has consistently decreased since 2015 whilst total debt has increased. I will cover this and the overall liquidity outlook in the next post.

This article is not investment advice and represents the opinions of its author, George Bartlett. All sources used are publicly available. No personal positions are held of the stocks in question.

Sources:

https://www.bdcinvestor.com/tpvg/

https://news.crunchbase.com/venture/vc-funding-downturn-charts-q1-2023/

https://find-and-update.company-information.service.gov.uk/company/05119483/filing-history

https://www.eweek.com/enterprise-apps/comdisco-trying-to-stay-afloat/

https://www.glassdoor.co.uk/Reviews/TriplePoint-Capital-Reviews-E238231.htm

https://s22.q4cdn.com/245062847/files/doc_financials/2022/q4/TPVG-12.31.22-10-K.pdf

https://www.chicagotribune.com/news/ct-xpm-2001-06-07-0106070201-story.html

https://www.cbinsights.com/reports/CB-Insights_Venture-Report-2022.pdf?