Line-item investing

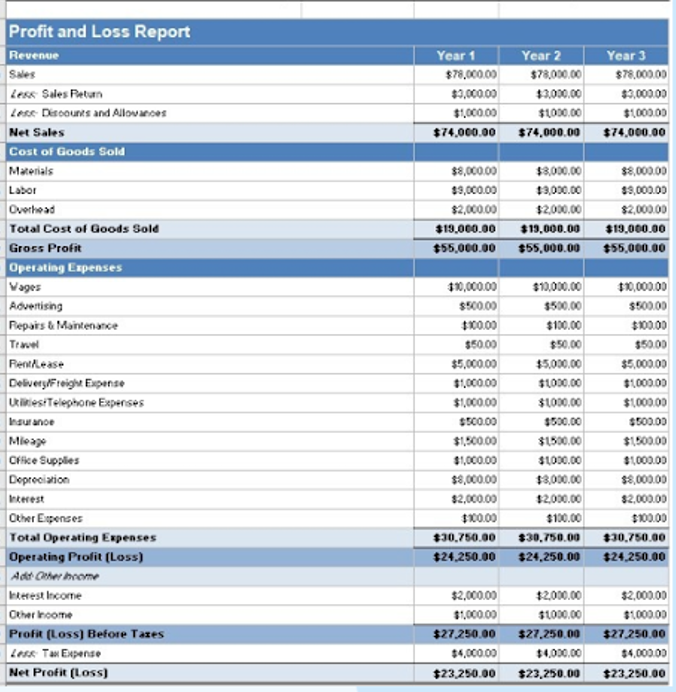

Line-items in a PnL

One framework I started to think more and more about for understanding and sourcing interesting software deals is line-item investing. I have not heard this term anywhere else so assume I have coined it for now.

The idea is to look for strong market trends (offline retail to online retail, the rise of on-demand services such as Uber/Deliveroo, neo-banks such as Monzo, Crypto exchanges etc.) and start to paint a picture of what software tools are mission critical to running and growing their businesses i.e. what direct/fixed costs would show up as line items in their financials that are purely for software. I first thought about this when we looked at a company called Funnel.io in Sweden. I saw that one of their customers was a portfolio company of ours and looked into their expenses and saw a regular monthly cost for Funnel in the marketing expenses. From this viewpoint you can start to build a sense of how important Funnel is based on the amount of cost per month invested (low or high Annual Contract Value) and how long they have been paying these monthly costs/what the usage is (retention). Seeing this company’s product as an expense line for another business was a different perspective to my diligence and quite helpful in judging whether they can be regular line-items in lots of other businesses long-term. Other questions start to emerge too, such as “If this cost is in sales and marketing expenses then how has that expense line trended? Is this an area that customers will maintain and grow investment in? Is this an area that has sway over technology budgets? Is this cost critical to maintaining revenue/the product etc in a downside?”.

This idea then cropped up in another company we were looking at that was doing boiler and heating installs/insurance in the DACH region. I was looking through the financials and saw a line-item for a fleet management software called Avrios (a company I just recently led an investment in at the time). This was a great earned truth for me and helped solidify some views around the importance of cloud-based fleet management software to that industry.

Since these two experiences occurred, I regularly try to look for software expense line-items in the companies that we look at, especially ones in interesting markets. Since this more deliberate approach was taken, I have come across all sorts of interesting software tools. A few more examples:

I met with a fashion/sneaker ecommerce company in Berlin in 2019 and was asking about their tech stack, presuming something like Magento or Shopify. However they told me they built it completely on an API/microservices architecture using a little known tool (at the time) called commercetools. This seemed very interesting given the flexibility of such an offering combined with the bold move to NOT use the easily available industry standard solutions like Shopify. Unfortunately we could not get in contact with the company in time and they went on to raise $150 million a few months after we heard of them…a little too late.

I met with a company building a personal investing/wealth management app for crypto assets. They were growing quite strongly as users started to deposit more assets to trade with onto the platform. I was looking through the financials and spotted a KYC verification tool called IDnow. I remember we had looked at the company previously but it was a pleasant surprise seeing their service manifested as a line-item in another business and a key part of their customer’s direct costs.

Since 2016 and especially since COVID-19, we have looked for all software cost line-items necessary for building large online retail businesses (i.e. ecommerce). This has in-part led to numerous investments for us in the modern ecommerce stack such as customer data platforms, on-site search/experience/personalisation and referral marketing tools.

More broadly, other more successful and well-known line-item investments might be Twilio, showing up as a mission-critical line-item cost in most brands looking to communicate with their customers over SMS/telephony/email. Another would be Stripe or Adyen, perhaps an even more mission critical service and line-item for any business looking to accept online payments quickly and flexibly.

I now almost always try to scrub expense lines of companies in good markets to uncover new software tools they use that enable their business; it can be a great primary data source for new tools and a channel with strong signal (people paying for the product) for potential investments.

I am very fond of these types of investments where as a software tool you can be a mission critical line-item in a whole industry’s growth. From an investor’s perspective, it is akin to putting a trade on that specific market without too much exposure to any one winner or loser (i.e. you are diversified across many customers in that industry and as a software tool can generate high margin sticky revenue long-term). I will continue to ask myself when looking at future investments: “Can this company be a mission critical line item in many businesses within that specific market?”